PASSIONIOT announced that it has completed a round B financing of several hundred million yuan. This round of financing was led by SAIF Partners, followed by CITIC Construction Investment Capital and Ginkgo Valley Capital. Potential Capital served as the exclusive financial advisor for this round of financing. This round of financing will mainly be used for technology research and development, global market expansion and layout, supply chain capacity improvement and organizational structure construction.

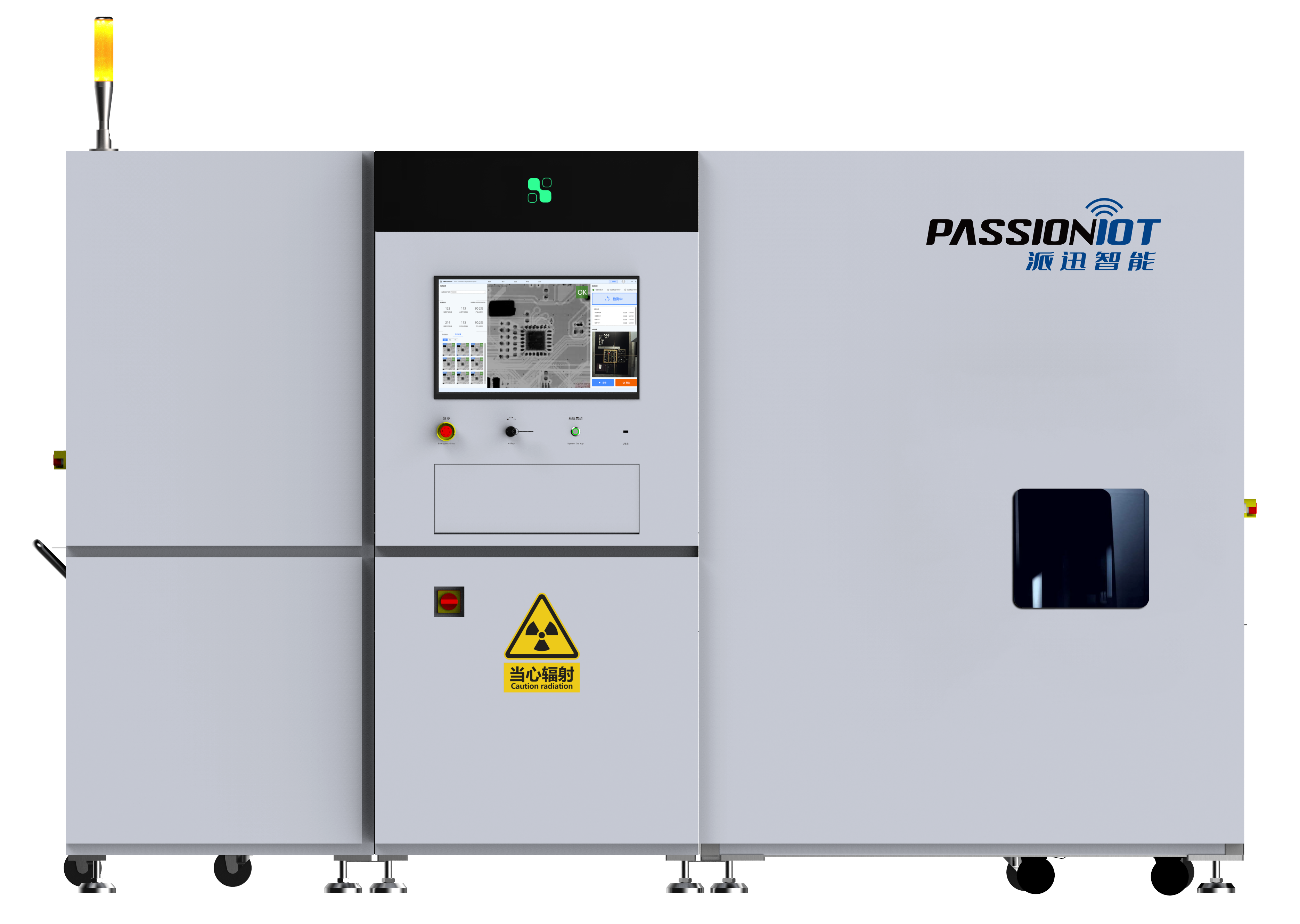

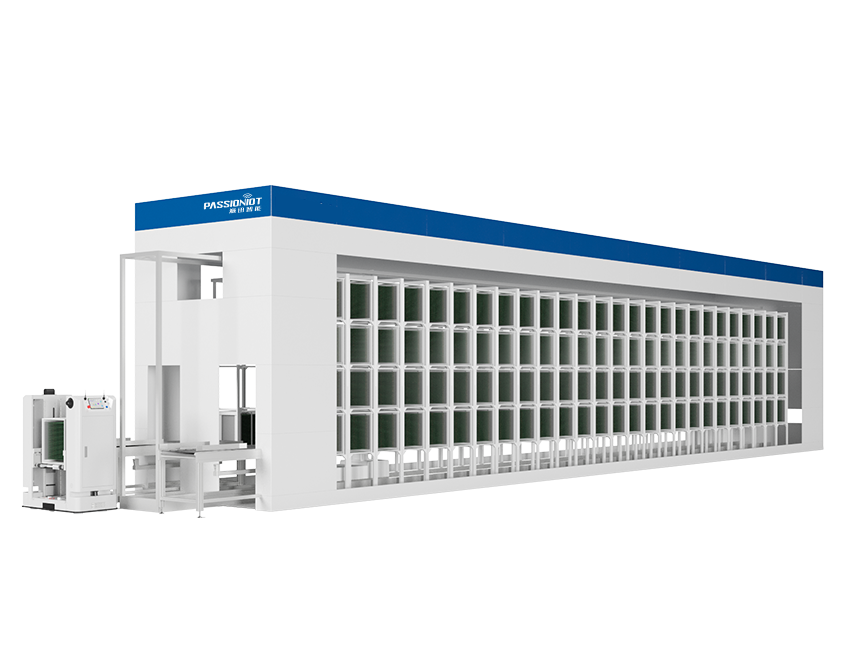

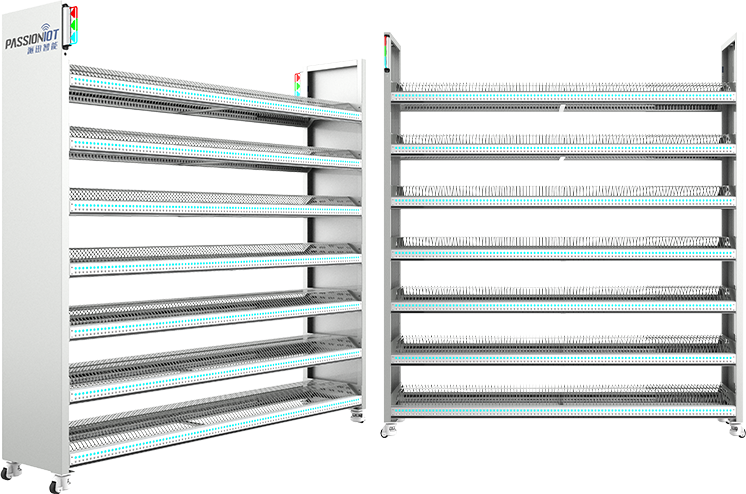

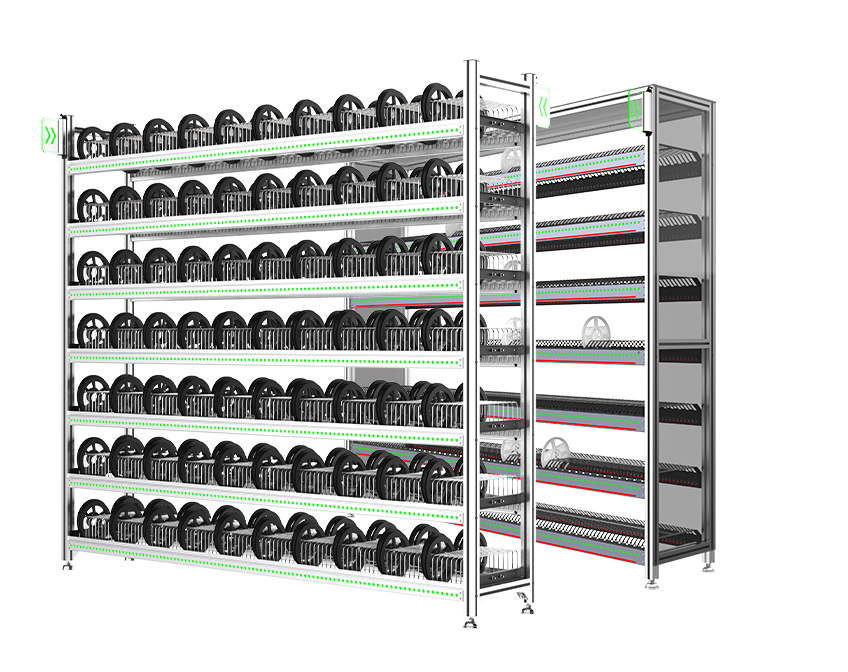

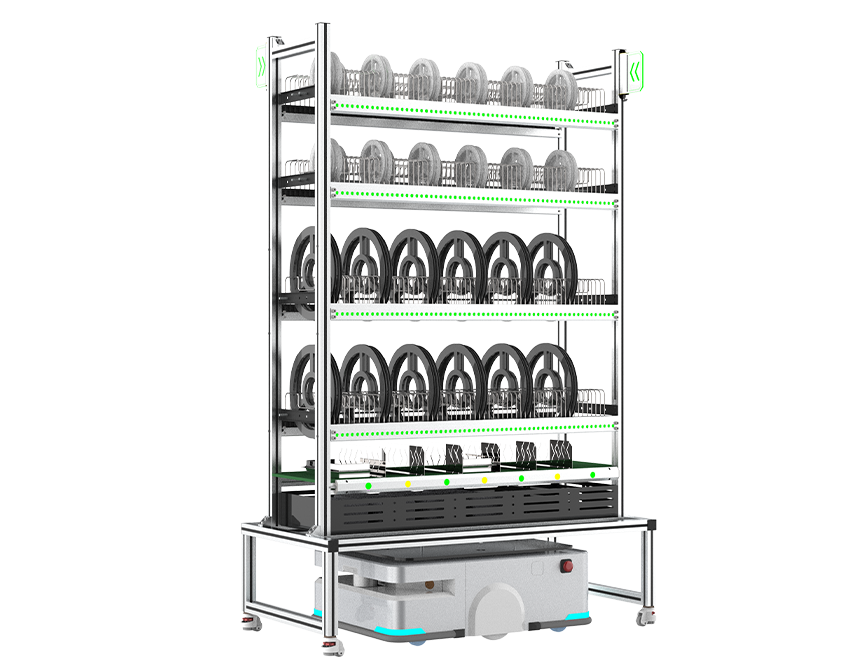

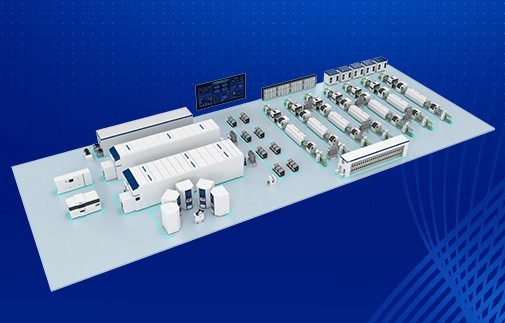

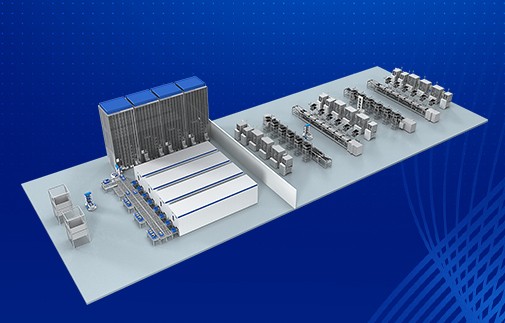

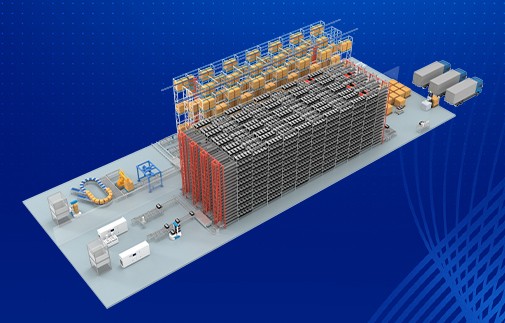

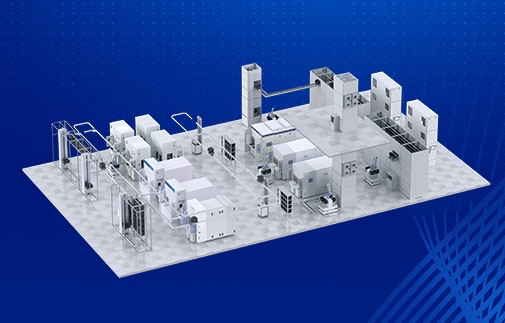

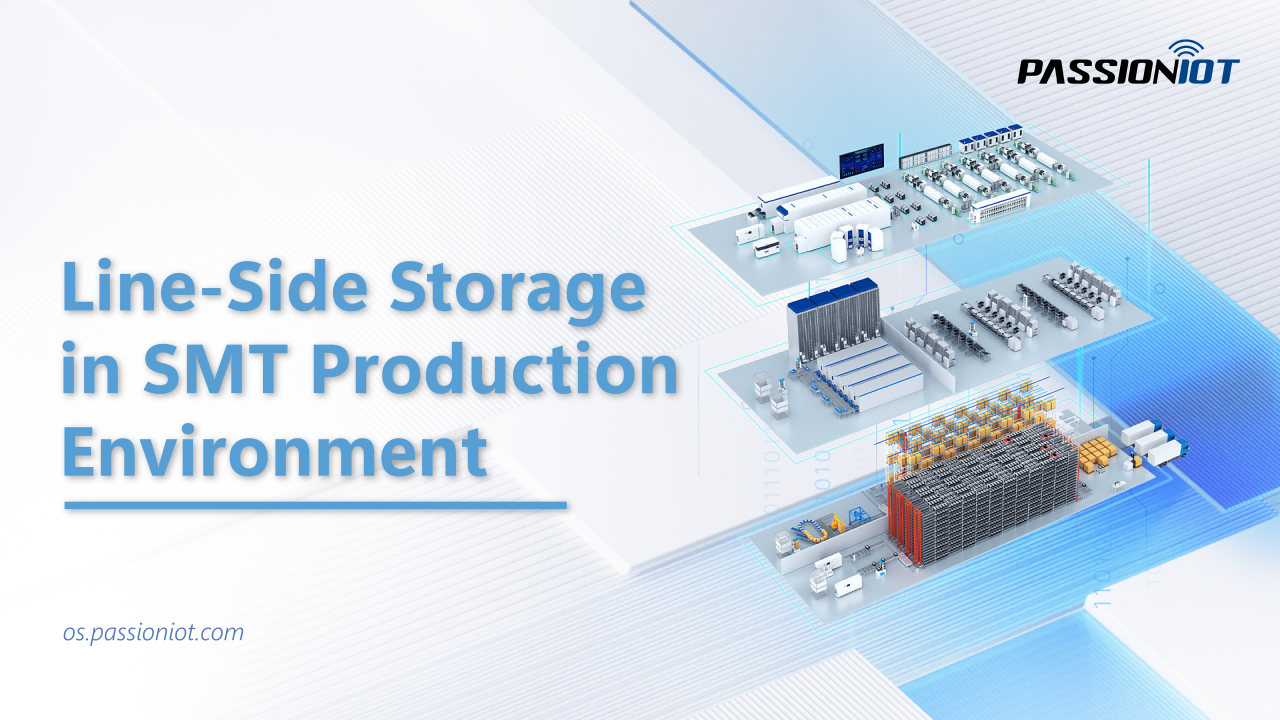

Founded in 2014, PASSIONIOT Intelligence is committed to providing discrete manufacturing customers with "intelligent line-side warehouse products + industry closed-loop overall solutions" for digital production.

PASSIONIOT links material flows through innovative standardized line-side warehouse products, connects data flows through self-developed software systems, and expands to the upstream and downstream of production links through an integrated service model, providing customers with overall smart supply chain solutions throughout the entire production process, creating new infrastructure for enterprises' "digitalization" transformation and upgrading.

So far, the company has helped many Fortune 500 companies successfully build "lighthouse factories" and has more than 200 projects in operation. Its customers include leading companies in the fields of semiconductors, new energy, national defense and military industry, consumer electronics, automotive electronics, rail transportation, power and electrical. Previously, Paixun Intelligence had received multiple rounds of financing from investment institutions such as Ginkgo Valley Capital, AA Investment, and Shunrong Capital.

Regarding this round of financing, PasionIOT founder and CEO Li You said: "The reason why we have won the favor and trust of many investment institutions and customers is not only because PASSIONIOT has been continuously expanding its territory and deepening its industry in the past few years, but the most important thing is our culture and values. The foothold of any strategy of PasionIOT is focused on how to solve the actual pain points of customers and how to deeply empower the industry and customers. In the future, PASSIONIOT will continue to play the role of an industry digital enabler, adhering to the mission of "creating the best products and creating the greatest value for customers", and contributing solid strength to promoting the digital transformation and upgrading of China's manufacturing industry."

Regarding the next development of PASSIONIOT, Hua Xin, co-founder and COO of Paxun Intelligence, said: "With the trust and expectations of investors, customers and many partners, we will continue to uphold the values of 'customer first, innovation, truth-seeking and pragmatism, and sincere unity', adhere to the development strategy of 'standardized line-side warehouse products + industry closed-loop solutions', accelerate the domestic high-end market's domestic 'creation' substitution, and vigorously expand overseas markets. In the past two years, PASSIONIOT's revenue has achieved a nearly 3-fold growth. In the next three years, achieving a quantum leap in revenue scale is our unswerving business goal."

Li Jia, partner of SAIF Partners, the lead investor in this round, said:

Smart manufacturing is an important investment sector of SAIF Investment Fund. Among the five elements of industry, namely, “people, machines, materials, methods and environment”, we have invested in the three links of “storage, picking and distribution” of “materials”. Earlier, we invested in JIKA Robotics and Xiangong Intelligent, completing the layout of the two major scenarios of “picking and distribution”. This time, we invested in Passion Intelligent, completing the coverage of the application scenario of “storage”. Passion Intelligent is a rare enterprise in the industry that has both “standardized line-side warehouse product development capabilities + software platform integration service capabilities”. At the same time, we also noticed that the core team of PASSIONIOT comes from well-known scientific research institutes and industry leading customers, with rich experience in product development and industrialization, and has built deep technical barriers in the fields of software technology, precision control, AIoT technology, edge computing, visual inspection and other scientific and technological fields. With the rapid expansion of Passion Intelligent’s domestic and overseas markets, the continuous enrichment of its product lines, and the continuous improvement of its global delivery capabilities, it is expected to grow into a global supplier of smart manufacturing products and solutions in the future. We continue to be firmly optimistic about PASSIONIOT.

Li Hui, deputy general manager of CITIC Construction Investment Capital, said:

As an innovation-driven technology company, Paixun Intelligence has achieved business coverage in multiple fields and scenarios, and its market share is in a leading position in multiple segments, with great room for growth. We hope that Paixun Intelligence can actively respond to the national advanced manufacturing development strategy with the help of this investment, focus on the intelligent line-side warehouse system of digital production, seize industry development opportunities, break the monopoly of foreign technology, and build a solid foundation for "Digital China".

Ginkgo Valley Capital, as the lead investor in Paixun Intelligent's Series A financing, continued to increase its investment in this round. Chen Bin, investment partner of Ginkgo Valley Capital, said:

PASSIONIOT has an excellent founding team, solid product development and efficient delivery capabilities, focusing on the deep integration of digital technology and industry scenarios. In the past year, it has continuously built its own broad "moat" in the industry segmentation field. We are full of confidence in the future development of PASSIONIOT. We look forward to PASSIONIOT's continuous innovation in technology and products, and continuously creating value increments for the digital transformation and upgrading of the manufacturing industry.

About SAIF Partners:

SAIF Partners is a leading private equity firm that provides financial support to high-growth companies in the Asia-Pacific region. It is one of the earliest large-scale equity investment fund management platforms in China. Many companies have grown rapidly after receiving SAIF investment and have been successfully listed on stock exchanges in the United States, Hong Kong, China, and mainland China. SAIF Partners' main investment areas include: information technology (big data, AI, cloud computing, mobile Internet, Internet of Things, etc.), intelligent manufacturing (industrial Internet, automation, robots, etc.), new energy/new materials (semiconductors, nanomaterials, energy conservation and environmental protection, etc.), medical health, consumer products, modern service industries and other industries.

About CITIC Construction Investment Capital:

CITIC Construction Investment Capital Management Co., Ltd. (hereinafter referred to as "CITIC Construction Investment Capital") is a wholly-owned subsidiary of CITIC Construction Investment Securities, specializing in private investment fund management business. The funds it manages include venture capital funds, equity investment funds, and infrastructure investment funds that serve national strategic planning and policy orientation. CITIC Construction Investment Capital's customer base includes large state-owned enterprises, private enterprises, government agencies, foundations, banks, insurance companies, and high-net-worth individual investors; the investment targets are mainly high-growth enterprises with listing prospects and enterprises with M&A value in industrial integration; the industry fields cover biomedicine, energy conservation and environmental protection, infrastructure, information technology, culture and education, high-end equipment, etc.

About Ginkgo Valley Capital:

Ginkgo Valley Capital is a major innovation of the Zhejiang Industrial Capital Alliance in cultivating emerging industries: with the patience of industrialists and the vision of investors, it gradually introduces traditional industrial capital into the new economic field, thereby realizing the transformation and upgrading of traditional industries and the prosperity and development of emerging industries. Ginkgo Valley Capital relies on the investment team with semiconductor genes and has long been committed to researching, cultivating and investing in emerging industries, and has gradually formed five key layout directions: digital manufacturing, enterprise services, life sciences, semiconductors, and urban brains. It has invested in and incubated more than 200 early-stage technology companies.